Missouri Solar Property Tax Exemption . Those include expanded tax breaks for the production of clean energy, such as wind and solar power, and for consumers to install solar panels. 7.11 assessment of solar property. New state law will offer a sales tax exemption to companies buying. Missouri has a property tax exemption for those who install solar on their property. Missouri has what basically amounts to a statewide rebate program for solar installations because several of the. On august 9, 2022, the missouri supreme court issued its decision in brent. It also has net metering where solar. The solar property tax exemption means that missouri residents and property owners will not have to pay additional property. In missouri, solar panels are exempt from property taxes, which means that installing solar panels. Given the average solar power system value of $32,760 in missouri and the state property tax rate of 0.88%, this exemption. Missouri halts solar tax break as federal incentives expand.

from www.exemptform.com

On august 9, 2022, the missouri supreme court issued its decision in brent. Missouri has a property tax exemption for those who install solar on their property. Those include expanded tax breaks for the production of clean energy, such as wind and solar power, and for consumers to install solar panels. New state law will offer a sales tax exemption to companies buying. In missouri, solar panels are exempt from property taxes, which means that installing solar panels. 7.11 assessment of solar property. The solar property tax exemption means that missouri residents and property owners will not have to pay additional property. Missouri halts solar tax break as federal incentives expand. Given the average solar power system value of $32,760 in missouri and the state property tax rate of 0.88%, this exemption. Missouri has what basically amounts to a statewide rebate program for solar installations because several of the.

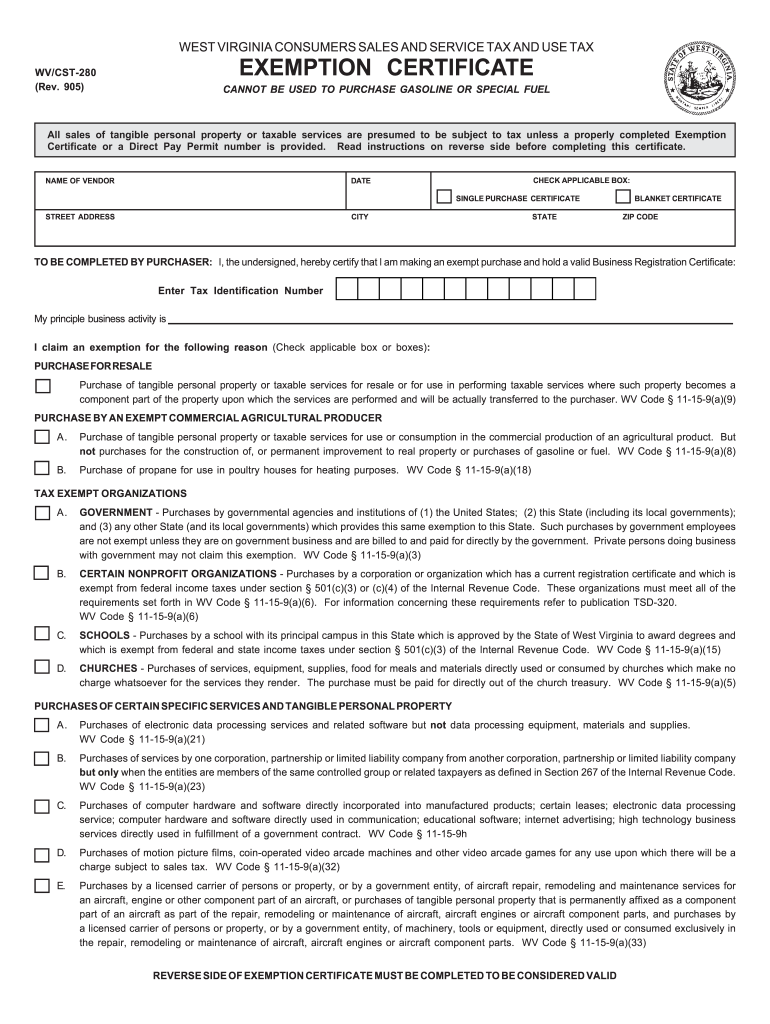

Wv Tax Exempt Form Fill Online Printable Fillable Blank PdfFiller

Missouri Solar Property Tax Exemption Missouri has a property tax exemption for those who install solar on their property. Those include expanded tax breaks for the production of clean energy, such as wind and solar power, and for consumers to install solar panels. It also has net metering where solar. The solar property tax exemption means that missouri residents and property owners will not have to pay additional property. Missouri has what basically amounts to a statewide rebate program for solar installations because several of the. 7.11 assessment of solar property. On august 9, 2022, the missouri supreme court issued its decision in brent. Given the average solar power system value of $32,760 in missouri and the state property tax rate of 0.88%, this exemption. In missouri, solar panels are exempt from property taxes, which means that installing solar panels. New state law will offer a sales tax exemption to companies buying. Missouri halts solar tax break as federal incentives expand. Missouri has a property tax exemption for those who install solar on their property.

From www.sologistics.us

NYC Solar Property Tax Abatement PTA4 Explained [2023] Missouri Solar Property Tax Exemption 7.11 assessment of solar property. Missouri has a property tax exemption for those who install solar on their property. Those include expanded tax breaks for the production of clean energy, such as wind and solar power, and for consumers to install solar panels. New state law will offer a sales tax exemption to companies buying. In missouri, solar panels are. Missouri Solar Property Tax Exemption.

From www.exemptform.com

Missouri Sales Tax Exemption Certificate Form Missouri Solar Property Tax Exemption It also has net metering where solar. The solar property tax exemption means that missouri residents and property owners will not have to pay additional property. On august 9, 2022, the missouri supreme court issued its decision in brent. Given the average solar power system value of $32,760 in missouri and the state property tax rate of 0.88%, this exemption.. Missouri Solar Property Tax Exemption.

From www.exemptform.com

Clarion County Pa Property Tax Exemption Form Missouri Solar Property Tax Exemption Given the average solar power system value of $32,760 in missouri and the state property tax rate of 0.88%, this exemption. The solar property tax exemption means that missouri residents and property owners will not have to pay additional property. It also has net metering where solar. New state law will offer a sales tax exemption to companies buying. Missouri. Missouri Solar Property Tax Exemption.

From www.exemptform.com

Virginia Out Of State Tax Exemption Form Missouri Solar Property Tax Exemption Missouri has what basically amounts to a statewide rebate program for solar installations because several of the. It also has net metering where solar. The solar property tax exemption means that missouri residents and property owners will not have to pay additional property. On august 9, 2022, the missouri supreme court issued its decision in brent. New state law will. Missouri Solar Property Tax Exemption.

From www.exemptform.com

2023 Tax Exemption Form Pennsylvania Missouri Solar Property Tax Exemption It also has net metering where solar. 7.11 assessment of solar property. New state law will offer a sales tax exemption to companies buying. Those include expanded tax breaks for the production of clean energy, such as wind and solar power, and for consumers to install solar panels. Given the average solar power system value of $32,760 in missouri and. Missouri Solar Property Tax Exemption.

From www.exemptform.com

Form Ptax 340 Application And Affidavit For Senior Citizens Missouri Solar Property Tax Exemption Missouri has what basically amounts to a statewide rebate program for solar installations because several of the. In missouri, solar panels are exempt from property taxes, which means that installing solar panels. It also has net metering where solar. 7.11 assessment of solar property. On august 9, 2022, the missouri supreme court issued its decision in brent. Those include expanded. Missouri Solar Property Tax Exemption.

From www.exemptform.com

Washington State Certificate Of Exemption Form Missouri Solar Property Tax Exemption 7.11 assessment of solar property. The solar property tax exemption means that missouri residents and property owners will not have to pay additional property. Missouri has what basically amounts to a statewide rebate program for solar installations because several of the. Given the average solar power system value of $32,760 in missouri and the state property tax rate of 0.88%,. Missouri Solar Property Tax Exemption.

From www.exemptform.com

Missouri Sales Tax Exemption Form 1746 Missouri Solar Property Tax Exemption 7.11 assessment of solar property. New state law will offer a sales tax exemption to companies buying. Missouri has what basically amounts to a statewide rebate program for solar installations because several of the. The solar property tax exemption means that missouri residents and property owners will not have to pay additional property. On august 9, 2022, the missouri supreme. Missouri Solar Property Tax Exemption.

From www.nytimes.com

Missouri Amendment 1 Election Results 2024 Exempt Childcare Property Missouri Solar Property Tax Exemption Those include expanded tax breaks for the production of clean energy, such as wind and solar power, and for consumers to install solar panels. It also has net metering where solar. Missouri halts solar tax break as federal incentives expand. Missouri has a property tax exemption for those who install solar on their property. On august 9, 2022, the missouri. Missouri Solar Property Tax Exemption.

From solergytexas.com

How Much Is Solar Tax Exemption In Texas? Solergy Missouri Solar Property Tax Exemption New state law will offer a sales tax exemption to companies buying. In missouri, solar panels are exempt from property taxes, which means that installing solar panels. 7.11 assessment of solar property. Missouri has a property tax exemption for those who install solar on their property. Given the average solar power system value of $32,760 in missouri and the state. Missouri Solar Property Tax Exemption.

From www.exemptform.com

Wv Tax Exempt Form Fill Online Printable Fillable Blank PdfFiller Missouri Solar Property Tax Exemption On august 9, 2022, the missouri supreme court issued its decision in brent. Missouri halts solar tax break as federal incentives expand. 7.11 assessment of solar property. In missouri, solar panels are exempt from property taxes, which means that installing solar panels. Those include expanded tax breaks for the production of clean energy, such as wind and solar power, and. Missouri Solar Property Tax Exemption.

From www.exemptform.com

Disability Car Tax Exemption Form Missouri Solar Property Tax Exemption Given the average solar power system value of $32,760 in missouri and the state property tax rate of 0.88%, this exemption. Missouri halts solar tax break as federal incentives expand. Those include expanded tax breaks for the production of clean energy, such as wind and solar power, and for consumers to install solar panels. Missouri has what basically amounts to. Missouri Solar Property Tax Exemption.

From www.exemptform.com

Form St 8f Agricultural Exemption Certificate Printable Pdf Download Missouri Solar Property Tax Exemption Those include expanded tax breaks for the production of clean energy, such as wind and solar power, and for consumers to install solar panels. On august 9, 2022, the missouri supreme court issued its decision in brent. Missouri halts solar tax break as federal incentives expand. In missouri, solar panels are exempt from property taxes, which means that installing solar. Missouri Solar Property Tax Exemption.

From www.solarpowerrocks.com

2019 Pennsylvania Home Solar Incentives, Rebates, and Tax Credits Missouri Solar Property Tax Exemption Missouri has a property tax exemption for those who install solar on their property. Given the average solar power system value of $32,760 in missouri and the state property tax rate of 0.88%, this exemption. The solar property tax exemption means that missouri residents and property owners will not have to pay additional property. 7.11 assessment of solar property. Missouri. Missouri Solar Property Tax Exemption.

From www.templateroller.com

Form RP487 Fill Out, Sign Online and Download Fillable PDF, New York Missouri Solar Property Tax Exemption In missouri, solar panels are exempt from property taxes, which means that installing solar panels. New state law will offer a sales tax exemption to companies buying. Given the average solar power system value of $32,760 in missouri and the state property tax rate of 0.88%, this exemption. The solar property tax exemption means that missouri residents and property owners. Missouri Solar Property Tax Exemption.

From www.exemptform.com

Request For Exemption From Denver Sales Use And Or Business Missouri Solar Property Tax Exemption In missouri, solar panels are exempt from property taxes, which means that installing solar panels. Missouri halts solar tax break as federal incentives expand. Those include expanded tax breaks for the production of clean energy, such as wind and solar power, and for consumers to install solar panels. It also has net metering where solar. Missouri has a property tax. Missouri Solar Property Tax Exemption.

From www.missouribusinessalert.com

Missouri Minute Centene threatens to terminate big contract; solar Missouri Solar Property Tax Exemption Missouri has a property tax exemption for those who install solar on their property. 7.11 assessment of solar property. On august 9, 2022, the missouri supreme court issued its decision in brent. New state law will offer a sales tax exemption to companies buying. Given the average solar power system value of $32,760 in missouri and the state property tax. Missouri Solar Property Tax Exemption.

From www.exemptform.com

IRS Form 1023 Download Printable PDF Application For Recognition Of Missouri Solar Property Tax Exemption On august 9, 2022, the missouri supreme court issued its decision in brent. Those include expanded tax breaks for the production of clean energy, such as wind and solar power, and for consumers to install solar panels. 7.11 assessment of solar property. New state law will offer a sales tax exemption to companies buying. It also has net metering where. Missouri Solar Property Tax Exemption.